12 min read — Analysis | Policy | China

Win-Win or Trojan Horse? Assessing Chinese FDI in Central and Eastern Europe

January 28, 2024 | 10:30

The Silk Road established by the Han Dynasty around 130 BC played a pivotal role in connecting the far East with both the Middle East and Europe.

This ancient network embodied ‘the spirit of peace and cooperation, openness and inclusiveness, mutual learning and benefit’, which Xi Jinping has attempted to revitalise through the creation of the ‘Belt and Road Initiative’(BRI).

Xi’s administration has been focusing on achieving the famous ‘Fuxing zhi lu’ (Chinese Dream), consisting of rejuvenating China and creating new patterns of international relations among world powers. The BRI is part of this project and has been extended into Europe through the 16+1 framework, an agreement on economic cooperation between China and Central and Eastern European countries (CEEs).

Whilst CEE countries have welcomed Chinese financial investments, following the Global Financial Crisis, there has been growing opposition to Chinese foreign direct investments (FDI) on grounds of national security and European unity concerns – particularly from Brussels. European Union opposition towards Chinese FDI is reflected in the Commission’s tripartite definition of China as a ‘partner, competitor, rival’, published in 2019’.

This research paper therefore aims to examine how an increase in Chinese FDI to CEE countries will impact Sino-EU political relations, by 2035. This time frame is chosen for its balance between immediacy and long-term perspective, crucial for understanding the profound impact on Sino-EU political relations and the region’s economic landscape.

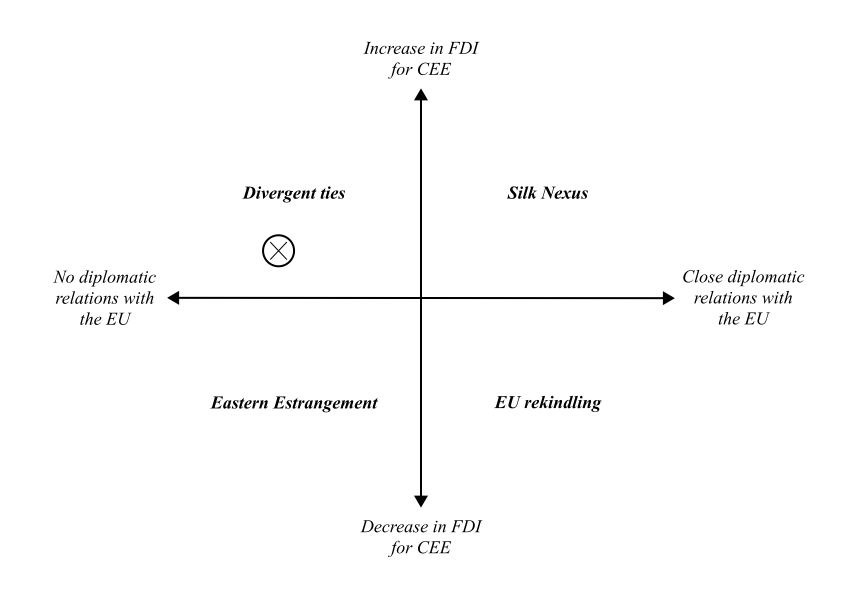

Scenario Matrix for 2035

To analyse the future diplomatic ties between China and the EU, this paper utilises a 4 scenario matrix, sketching out possible circumstances for 2035.

On the y axis, one can identify an ‘Increase / Decrease in FDI in CEE’. To clarify, this addresses whether the Chinese government will increase or decrease FDI as part of their BRI project to CEE countries.

‘Close / No diplomatic relations with the EU’ are the scenario extremes presented on the x axis. For the purpose of this research paper, the term diplomatic relations is reduced to political alliances and cooperation.

Analysis of the scenarios

The first scenario is labelled ‘Silk Nexus’. In such a situation, China increases its FDI spending in CEE countries and pursues closer diplomatic relations with the EU. This is Xi’s ideal outcome, as economic and political cooperation with Europe would enhance China’s role on the global stage.

The second scenario is titled ‘EU rekindling’, where China decreases its FDI in CEE and improves diplomatic relations with the EU. In this case China’s economic influence in CEE diminishes, however this is compensated by stronger rapprochement with the EU. Arguably, this is the least likely scenario.

Least favourable outcome for China would be ‘Eastern Estrangement’, wherein China loses out on benefits that arise from a political and economic partnership with Europe.

The last scenario is ‘Divergent ties’. Here, China increases its investing in CEE, however its diplomatic relations with the EU deteriorated. This paper proposes that this is the most likeliest outcome for 2035, which is discussed in the following section.

Chinese Investment in Central and Eastern European Countries

On October 9th 2023, a comprehensive government report of China’s Outbound Direct Investment in 2022 was released, offering an overview of the country’s investment activities. According to the report, China reached 163.12 billion USD in investment spending in 2022, making it the second largest global investor. Europe received 10.2% of this investment.

China has started heavily investing in CEE since April 2012 when eleven EU members and five Balkan countries signed an agreement stating their interest in participating in the BRI Initiative.

However, despite their voluntary participation, there are growing concerns over Chinese investments in critical national infrastructure such as Port Piraeus and CDP Reti.

Case Study 1: Port Piraeus

The Greek Port of Piraeus has been labelled the “The Dragon Head” the BRI. China Ocean shipping company (COSCO), a Chinese state-owned enterprise (SOE), first purchased 2 out of 3 piers of the port, thereby acquiring their ownership for the period between 2009 and 2044. COSCO went on to invest 280.5 million euros for a 51% share and later an additional 88 million for another 16% share over the port’s ownership.

Ever since the port’s largeness ranking has improved from 93rd in 2010 to 26th globally, now representing the 4th biggest port Europe-wide. China’s Daily has described the project as a ‘win-win cooperation between China and Greece’, as it helped recover the Greek economy and created a geo-strategic point from where Chinese goods seamlessly can enter Europe. Simultaneously, the renovation of the port has led to mounting concerns regarding ‘pollution, bad working conditions and unfair competition’.10 Security fears have been raised, the analysis of which will be entertained later.

Case Study 2: CDP Reti

Similar concerns have arisen when the State Grid Corporation of China (SGCC) acquired 35% of CDP Reti, an Italian holding company that controls Italy’s energy infrastructure networks (Briefing 2023). Unlike in Port Piraeus, the Chinese SOE doesn’t have the majority share of CDP Reti, nevertheless it is permitted to have Chinese representatives to sit its board, raising concerns over ‘infiltration, espionage and disruption’.

The details of both cases need to be analysed in greater depth to establish the real security risks they impose on the EU. The Global Times labels these SOE investments as a ‘win-win’ and expects Chinese corporations to embed themselves within CEE, whilst security concerns continue to rise in Western Europe. Such mounting concerns have materialised into multiple policy mechanisms such as ‘investment screenings, international procurement instruments and a planned law package aimed at monitoring and combating foreign interference’. Additionally, the president of the European Commission, Ursula von der Leyen suggested a ‘de-risking proposal’ in March of 2023, for navigating the dependency risk with China. Although this proposition has not been operationalised as of yet, it reflects how an increase in FDI in CEE and Southern Europe has led to the EU imposing a number of security mechanisms, rather than strengthening diplomatic ties with China.

From Brussels to Beijing: CEE’s geostrategic shift

Additionally, Chinese FDI poses a threat to European unity, as critics argue that the ‘16+1’ scheme is a ‘Trojan horse’, aimed to ‘divide and conquer’ the EU.

China is doing this by utilising its FDI to corrupt CEEs, especially EU members, in order to ‘block EU policies it opposes and divide the union from within’.

This became apparent in recent years as China’s increasingly authoritarian government has diminished both democracy in Hong Kong and the human rights of Uyghur Muslims in Xinjiang. Indeed, when the EU was planning to publish several statements condemning these state actions, Hungary blocked the initiative the country that has arguably benefited the most from Chinese FDI over the last decade. Exemplified in this is how China’s economic contributions have gained the political favour of certain CEEs.

Similarly, the EU has heavily criticised China for its ‘no-limits friendship’ with Russia in wake of its war with Ukraine, which contributed to Estonia and Latvia withdrawing from the ‘16+1’ agreement. Hungary’s Prime Minister Viktor Orbán on the other hand, again turned to support Beijing instead of Brussels, by being the only EU leader to attend the 2023 BRI forum, where he also met with Russian President Vladimir Putin. After the Forum, China described Hungary as a ‘trusted friend and partner in the EU’, whilst the EU is increasingly struggling to demonstrate a united front on diplomatic matters.

Evaluation

Although this paper argues that ‘Divergent ties’ is the most likely outcome for 2035, some think tanks claim that China’s FDI is not a significant threat to EU security or unity, which may alter Sino-EU diplomatic relations.

Firstly, China states that it is not in its interest to weaken the EU, as the primary goal of FDI in CEE is to create a ‘transportation gateway to Western Europe’. Germany being the economic powerhouse of Europe, Chinese Multinational Corporations utilise their investments especially in the Visegrad 4 group to access German markets. Therefore a weak and divided Europe arguably doesn’t serve China’s interests.

Secondly, whilst Hungary has been an active supporter of Xi, Orbáns government has never published an official China Strategy. More importantly, Hungary remains a member of both the EU and NATO, meaning that even though Orbán is pursuing an illiberal democracy, it ultimately remains a Western ally. All CEE countries that are members of the EU or NATO are similarly embedded within the Western alliance framework, making it difficult for China to cause a significant divide within Europe by 2035.

Lastly, one must not forget that Chinese FDI improves local economies such as that of Greece. Whilst many countries are suspicious of the BRI project, it would and has already improved transportation networks, which is of benefit for all EU members. Therefore, if the EU continues to allow Chinese FDI through monitoring schemes, perhaps the ‘Silk Nexus’ could be achieved by 2035, however this demands cooperation from both sides.

Conclusion

Overall, one can determine that there is a complex dynamic between Chinese FDI in CEE and Sino-EU relations. As of yet, China hasn’t demonstrated its geopolitical influence over Europe, however EU security concerns are justifiable. The fact that Chinese SEOs are seeking to invest in national infrastructure and have gained the support of populist countries such as Hungary, provides reason to be alarmed. Additionally, the rise of populist governments across Europe may also cause a shift away from Brussels and more towards Beijing. It is clear that this topic requires further in-depth research, as Sino-EU relations are a critical juncture for European security.

Bibliography

Bartsch, Bernhard, and Claudia Wessling, eds. From a China Strategy to No Strategy at All: Exploring the Diversity of European Approaches. European Think-tank Network on China (ETNC) Report. 2023.

Comerma Calatyud, Laia. “The Complex Relationship between Europe and Chinese Investment: The Case of Piraeus.” Working paper, China Institute, King’s College London, 2023.

Economy, Elizabeth C. The World According to China. Cambridge: Polity, 2022. HISTORY. “Silk Road – Facts, History & Location.” HISTORY. 2017.

Lau, Stuart. “Down to 14+1: Estonia and Latvia Quit China’s Club in Eastern Europe.” POLITICO PRO, August 11, 2022.

Li, Xuanmin. “China-CEE BRI Cooperation Expected to Become ‘Deeper’ ‘Greener’ in Next Stage.” Global Times, October 17, 2023.

Maro, Zalan Mark, and Aron Torok. “China’s New Silk Road and Central and Eastern Europe —A Systematic Literature Review.” Sustainability (Basel, Switzerland) 14, no. 3 (2022):

Otero-Iglesias, Miguel, and Manuel Weissenegger. “Motivations, Security Threats and Geopolitical Implications of Chinese Investment in the EU Energy Sector: The Case of CDP Reti.” European Journal of International Relations 26, no. 2 (2020): 594–620.

Ramasamy, Bala, and Matthew Yeung. “China’s Outward Foreign Direct Investment (OFDI) to Developing Countries: The Case of Central and Eastern Europe (CEE).” Journal of the Asia Pacific Economy 27, no. 1 (2022): 132.

Wang Wenwen. “BRI Synergies ‘Opening to East’ of Hungary, Promotes World Economic Devt.” Global Times, October 18, 2023.

Wu, Yi. “China’s Outbound Investment: Recent Developments, Opportunities, and Challenges.” China Briefing, November 13, 2023.

Xinhua. “China Focus: Xi Urges ‘Belt and Road’ Construction to Benefit All.” Xinhua. 2017.

Zeng, Yuleng. “Riding the Trojan Horse? EU Accession and Chinese Investment in CEE Countries.” The Journal of Contemporary China ahead-of-print, no. ahead-of-print (2023): 1–16

Write and publish your own article on Euro Prospects

Subscribe to our newsletter – stay informed when we publish articles on pressing European affairs.